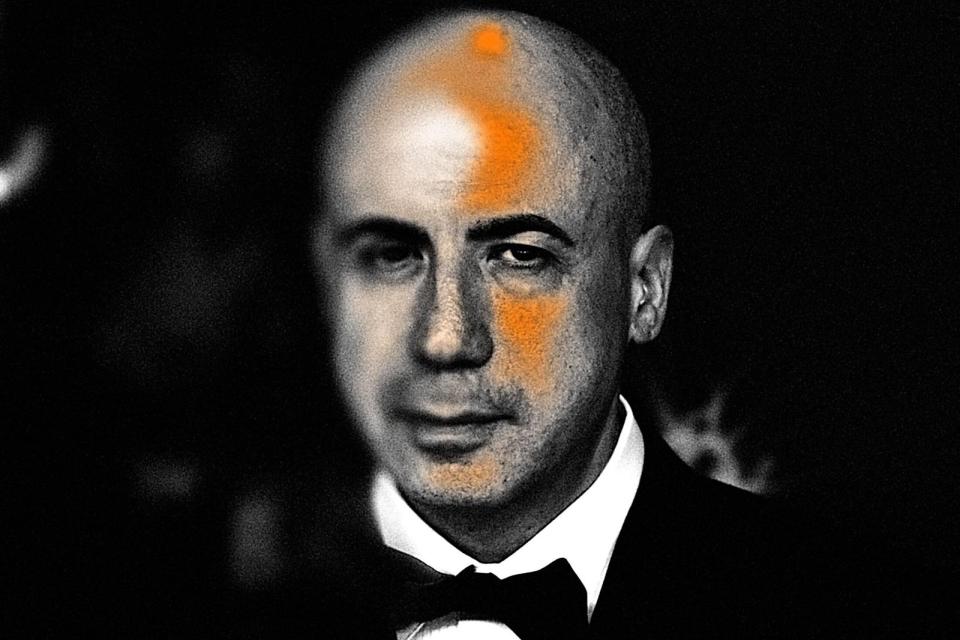

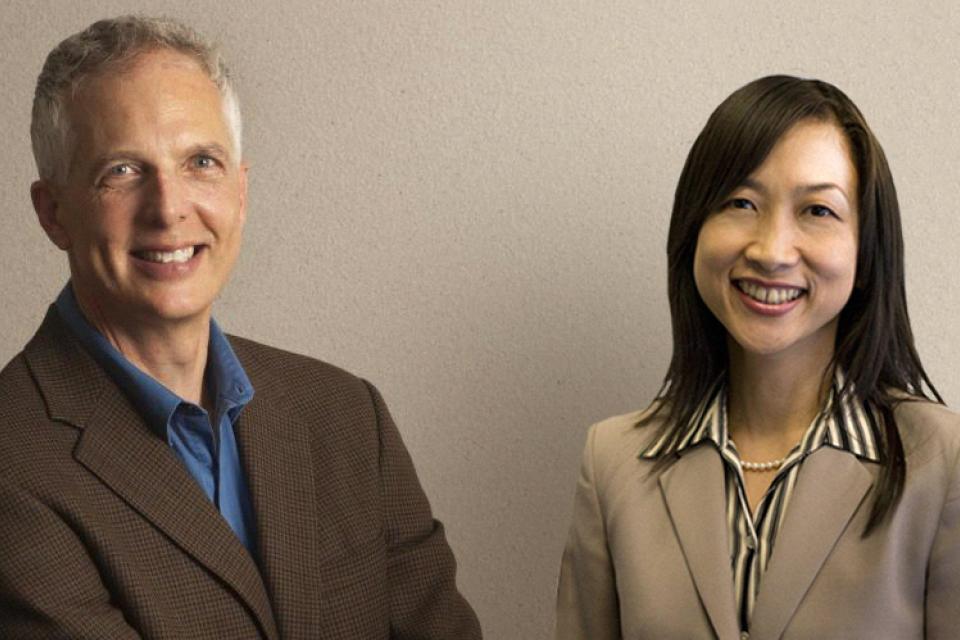

Ayako Yasuda

Professor, Maurice J. and Marcia G. Gallagher Chair in Finance

Ph.D., Economics, Stanford University, 2001

Research Expertise

Venture Capital, Private Equity, Sustainable Finance, Institutional Investing, Entrepreneurial Finance, Technology Finance

Ayako Yasuda is a professor of finance at the Graduate School of Management, University of California, Davis, where she holds the Maurice J. and Marcia G. Gallagher Chair in Finance. She is a senior fellow of the Asian Bureau of Finance and Economic Research (ABFER) and a fellow of the Private Equity Research Consortium.

Yasuda is an applied financial economist whose research focuses on venture capital, private equity, institutional investing and sustainable finance. Her recent work explores valuation practices in startup financing and the design and performance of sustainable mutual funds in the U.S. and Europe. She is particularly interested in how capital is allocated under conditions of illiquidity, uncertainty and long investment horizons, especially at the intersection of ESG considerations and both public and private market investing. Her work spans asset management, financial intermediation and corporate finance.

Her research has been published in leading academic journals including the Journal of Finance, the Journal of Financial Economics and the Review of Financial Studies. She is coauthor of the textbook Venture Capital and the Finance of Innovation (3rd edition, 2021), and her research has also been featured in The Wall Street Journal, The Economist, the Financial Times and The New York Times. Her 2021 article “Impact Investing” (published in the Journal of Financial Economics) received the Moskowitz Prize for sustainable and responsible investing and was a runner-up for the RAFI ESG Best Paper Award.

At UC Davis, Yasuda teaches Technology Finance and Valuation, Private Equity and Core Finance (Financial Theory and Policy). She is passionate about empowering students with practical finance and valuation skills.

She previously held an academic position at the Wharton School, served as an independent director at the Japan Investment Corporation and worked as a financial analyst at Goldman Sachs. She earned her Ph.D. and B.A. in economics from Stanford University, where she graduated Phi Beta Kappa with Dean’s Distinction.

Awards

- 2024 Asian Bureau of Finance and Economic Research (ABFER) Senior Fellow

- 2023 Institute for Private Capital, Best Paper of PERC Award Winner

- 2022 UC Davis Graduate School of Management Teacher of the Year

- 2019 John Muir Institute for the Environment Fellowship

- 2019 Private Equity Research Consortium (PERC) Research Fellow

- 2018 Research Affiliates Best Paper Award for ESG Runner-up “Impact Investing”

- 2018 The NBER Entrepreneurship Small Grant “Impact Productivity Measure: A Transformative Performance Metric for Social Entrepreneurship” supported by the Kauffman Foundation.

- 2016 Moskowitz Prize for Socially Responsible Investing “Impact Investing”