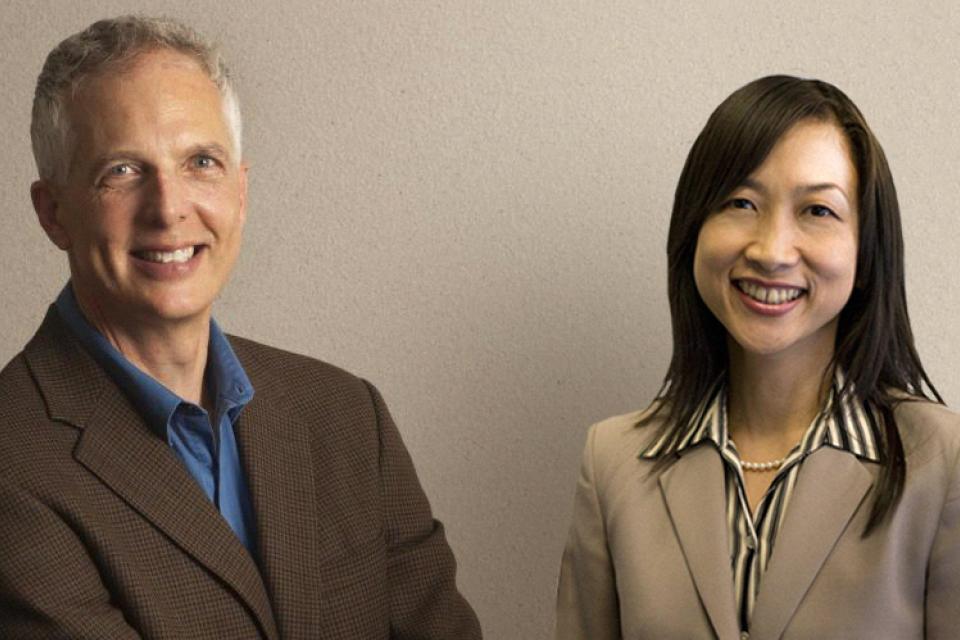

Brad M. Barber

Distinguished Professor Emeritus

AAAS Fellow

Ph.D., University of Chicago, Booth School of Business

Ph.D., University of Maryland

Research Expertise

Behavioral finance, asset pricing, gender, and private equity.

Teaching Expertise

Financial Theory and Policy

Distinguished Professor Emeritus Brad Barber is an internationally recognized authority on investor psychology, stock analyst recommendations, online trading, and mutual fund performance. His research includes the effect of expenses on money flowing into mutual funds, gender-related overconfidence in stock trading, the impact of coordinated trading by individual investors, and how active equity trading is hazardous to individual investor wealth.

His research has been covered extensively in the media, including Bloomberg BusinessWeek, Time, Reuters, the Wall Street Journal and The New York Times, and he has appeared on ABC News, NBC Nightly News, CNN, MSNBC and CNBC.

Fast Facts:

- One of the 50 most cited financial economists in the world.

- Internationally renowned investor behavior and finance expert whose work offers fresh insights on mutual funds, gender-related overconfidence in stock trading, reliability of stock analysts’ recommendations, and how active trading of equities is “hazardous to your wealth.”

Barber has experience consulting litigation support for financial fraud, antitrust and lost profits cases.

He is often quoted and his research has been covered extensively in the media, including Bloomberg BusinessWeek, Time, Reuters, the Wall Street Journal and the New York Times, and has appeared on ABC News, NBC Nightly News, CNN, MSNBC and CNBC.

He has published groundbreaking research in leading academic journals, including the Journal of Finance, the Journal of Financial Economics, The Review of Financial Studies, the Journal of Political Economy, The Quarterly Journal of Economics, American Sociological Review, the Journal of Financial and Quantitative Analysis, and the Financial Analysts Journal.

Barber’s research has twice been honored with UC Berkeley’s prestigious Moskowitz Prize for Socially Responsible Investing.

Barber received a Ph.D. in finance and an MBA from the University of Chicago as well as a B.S. in economics from the University of Illinois at Urbana-Champaign.

He teaches core finance classes in the UC Davis MBA program and personal finance to UC Davis undergraduates. He is a regular speaker at international academic and industry conferences.

You can learn more about Professor Barber at www.bradmbarber.com.