Big 3 with Dean H. Rao Unnava: Summer 2024

Record-breaking MSBA class | Four top scholars join faculty | Market risks from Supreme Court rulings

Dean H. Rao Unnava's Summer 2024 edition of the Big 3 features:

2024 Entering Class Represents the Largest in MSBA Program History

The record-breaking 2024 entering class has joined the UC Davis MSBA program that QS ranks No. 1 globally for return on investment and No. 2 worldwide for “Value for the Money.” Read blog>

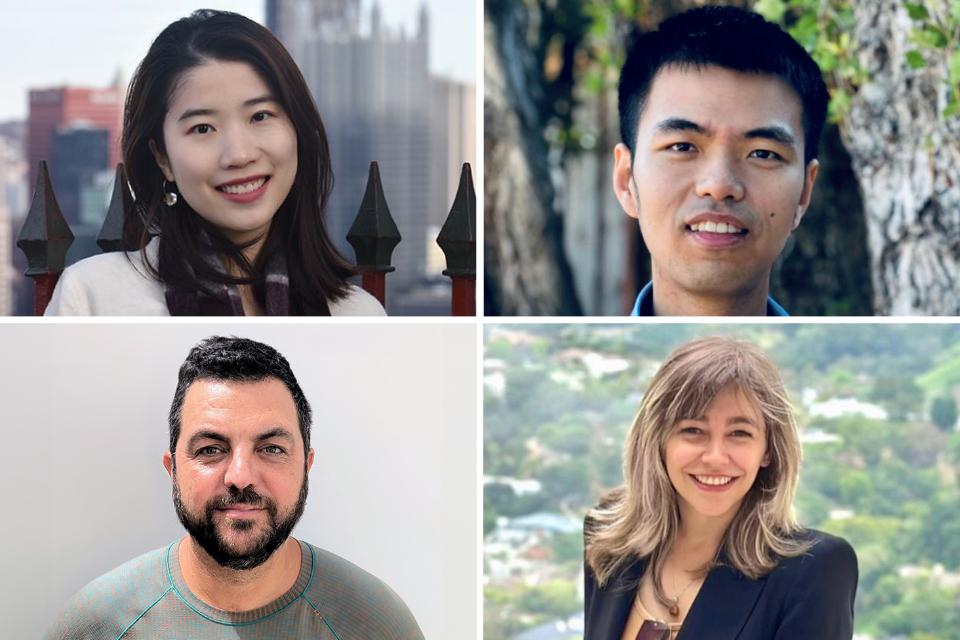

Four Top Scholars Join Faculty

With Ph.D.’s from Carnegie Mellon University, MIT, the University of Michigan and the University of Washington, the foursome shares a common interest in quantitative methods spanning big data, machine learning and AI in their research specializations. Read news release>

Will a Market Crash One Day Be Pinned on The Supreme Court?

Distinguished Professor Emeritus Paul Griffin warns in The Conversation that two recent Supreme Court rulings will limit the SEC's authority, weaken enforcement, increase investor risk, and ultimately might lead to a future stock market crash. Read news story>

Video Transcript

- 2024 Entering Class Represents the Largest in MSBA Program History

- Four Top Scholars Join Faculty

- Will a Market Crash One Day Be Pinned on The Supreme Court?

Welcome to the Summer 2024 edition of the Big 3 video newsletter.

2024 Entering Class Represents the Largest in MSBA Program History

We are thrilled to welcome a record-breaking 105 new Master of Science in Business Analytics students from around the world.

Our MSBA program is held in San Francisco, the hub of the global big data revolution. This is the largest class in the seven years since we launched our MSBA in 2017. It is our first MSBA class of over 100 students and one of the most diverse.

The students have come from eight U.S. states and ten countries across three continents, and they are 54% female. What's more, these master's students earned their undergrad degrees from 77 different universities, including UC Davis and four other UC campuses. They also bring experience from nearly 30 global companies such as Accenture, Baidu, Deloitte, IBM, Huawei, and Samsung, just to name a few.

Congratulations to our historic MSBA entering class of 2024.

Four Top Scholars Join Faculty

Also joining our community this summer are four new faculty members who earned their Ph.D.s at the likes of Carnegie Mellon University, MIT, the University of Michigan, and the University of Washington.

The foursome shares a common interest in quantitative methods spanning big data, machine learning, and AI in their research specializations.

Bita Hajihashemi joins us from the Spears School of Business at Oklahoma State University, where she was an assistant professor of marketing.

She focuses on the impact and implications of AI in marketing and the perils of personalized pricing. She's a native of Iran and earned her Bachelor of Science in chemical engineering from Sharif University of Technology in Tehran.

Yuan Yuan has worked at both Microsoft and Meta and joins us from Purdue University, where he was an assistant professor. Yuan uses big data and machine learning to study social and organizational networks. He's also exploring the capabilities of large language models in aiding social science studies.

Helen Zeng recently earned her Ph.D. in information systems and management at Carnegie Mellon. Her research lies in the intersection of digital economics, technology, and policy. More specifically, she explores societal harms in digital markets.

After five years as an assistant professor at the University of Michigan, Sebastian Calonico is continuing his economics research and teaching here at Davis. He has published more than 30 data analytics papers, many on health care policy and management.

We look forward to collaborating and learning from our new colleagues.

Will a Market Crash One Day Be Pinned on The Supreme Court?

Now, will a stock market crash one day be blamed on the US Supreme Court?

In a recent article in The Conversation, Distinguished Professor Emeritus Paul Griffin warns that two recent High Court decisions have him worried.

Professor Griffin is an internationally renowned accounting expert who has researched company financial shenanigans for nearly 50 years. He's a vocal advocate for public companies to disclose more about climate change risks in financial reports. His research has been cited in previous Supreme Court decisions and by regulators, setting policy for more transparency to benefit investors.

Paul is concerned about these two cases: The Securities and Exchange Commission v. Casey, which undercuts the SEC’s enforcement of securities laws, and Loper Bright Enterprises v. Raimondo. Loper cut back sharply on a long-standing doctrine–the Chevron rule–that gave federal agencies considerable freedom to craft rules and regulations.

Taken together, Paul says, the impact of these will limit the government's authority, weaken enforcement, and increase investor risk, and ultimately might lead to a future stock market crash. He writes that in the years or decades ahead, should the country face another serious financial crisis leading to a recession, it'll be harder to blame the accountants and investment bankers.

Instead, attention may turn to two mid-2024 court decisions and the justices who wrote them.

Thank you for watching this month’s Big 3!